Often you ask me what Venture Philanthropy is and what it achieves. I will hopefully clear up all your doubts in this post about the Invest for children foundation.

Venture Philanthropy is a growing international methodology focused on building stronger social organisations, offering them both funding and management support; with the sole objective of increasing their social impact. The word “social” is used because the impact must be social, medical, cultural or environmental. Venture Philanthropy is based on the investment model used by venture capitalists (hence the name), as financial support is also accompanied by advice from experts in the organisation’s sector.

Why choose Venture Philanthropy?

Venture Philanthropy is another tool in the social investment and philanthropy environment. This new investment model has emerged in Europe during the last decade as a highly focused approach to social investment and fundraising in a wide range of organisations with a social purpose, from foundations and NGOs to social enterprises. There are two important investment strategies known as Impact Investment: Impact First and Finance First strategies.

When social investment seeks to generate a predominant economic return, we are dealing with Finance First strategies, which are not included in our definition of Venture Philanthropy. This type of investment seeks to maximise economic return and social impact comes second.

But when the social impact is more important than the economic return, we find ourselves before the so-called Impact First strategies, which are the ones that define Venture Philanthropy and where Invest for children is included. Within the Impact First strategies we also find the so-called Grant funding strategies, where the donation received is not returned to the investing organisation; these are the so-called Impact Only strategies.

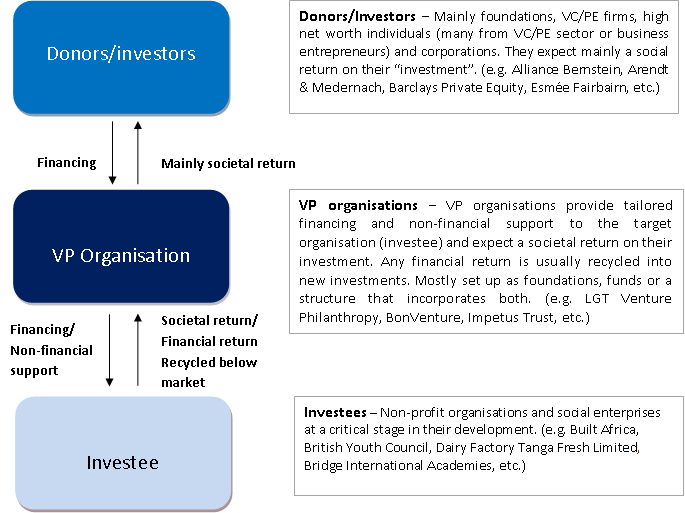

Here I copy this diagram from EVPA (European Venture Philanthropy Association) which clarifies the differences and overlaps between these terms:

Donors or investors are usually foundations, major investor networks, venture capital or private equity firms or organisations. They primarily expect a social return on their investments and therefore support Venture Philanthropy (VP) organisations.

VP organisations, such as Invest for children, provide tailored funding and non-financial support to the target organisation (investee) and expect a social return on their investment. Any financial return is reinvested in new investments. The investees are usually non-profit foundations or social organisations at a critical point in their development.

Donors or investors are usually foundations, major investor networks, venture capital or private equity firms or organisations. They primarily expect a social return on their investments and therefore support Venture Philanthropy (VP) organisations.

VP organisations, such as Invest for children, provide tailored funding and non-financial support to the target organisation (investee) and expect a social return on their investment. Any financial return is reinvested in new investments. The investees are usually non-profit foundations or social organisations at a critical point in their development.